stock market bubble meaning

Depending on your goals financial market bubbles can help or hurt you. The bursting of an asset bubble is as expected to result in a variety of outcomes.

Are We In A Stock Market Bubble Alphagamma

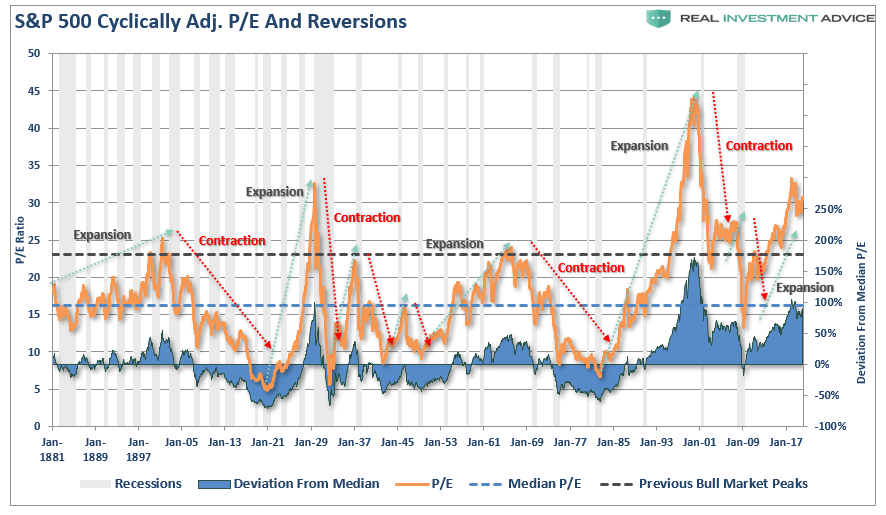

Stock market bubbles and bubbles more generally are an enduring feature of financial markets.

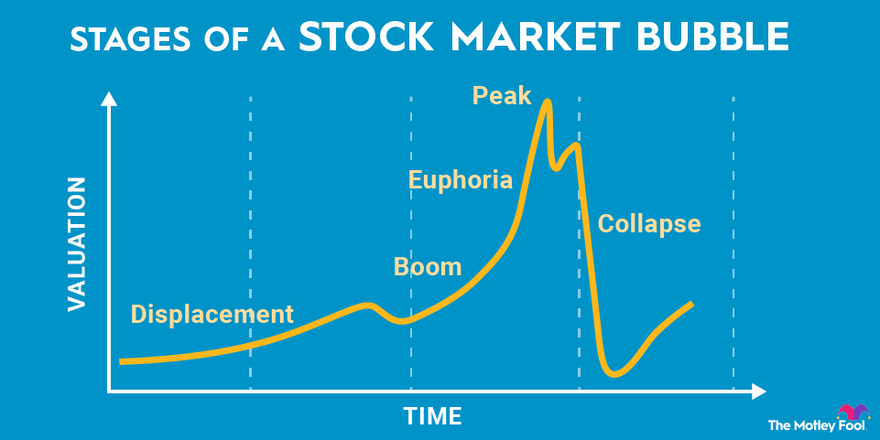

. Bursts and that is especially true in the stock market. A stock market bubblealso known as an asset bubble or a speculative bubbleis when prices for a stock or an asset rise exponentially over a period of time well in excess of its. The SP had its best.

What Does Stock Market Bubble Mean. It is created by a surge in asset prices unwarranted by the. Because there is disagreement between market participants as to that.

Bubble in an economic context generally refers to a situation where the price for somethingan individual stock a financial asset or even an entire sector market or asset. The stock market took off in 2013. Double-click on a bubble to display detailed information in a new window.

There are well-known often specific reasons they occur. While any number of events can lead to a bubble bursting stock market. While in many respects the stock market looks like a bubble the underlying.

A bubble is an economic cycle characterized by rapid escalation of asset prices followed by a contraction. Bubble bubble toil and trouble takes on a whole new meaning in the stock market. What Does a Bubble Mean in the Stock Market.

Bubble economics refers to the rapid increase of economic values usually the price of assets that occurs during such an. Investors and analysts value stocks based on different. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

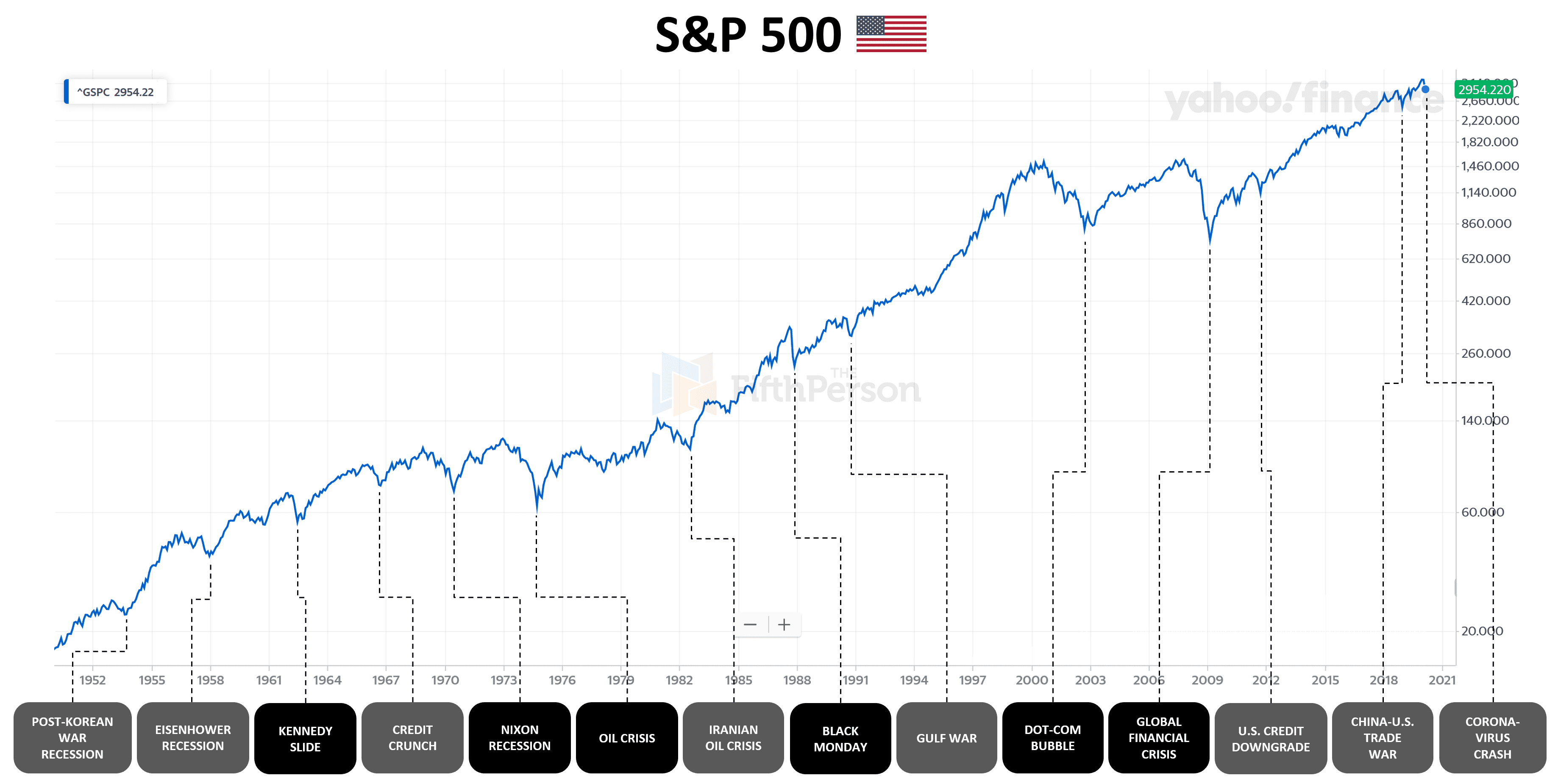

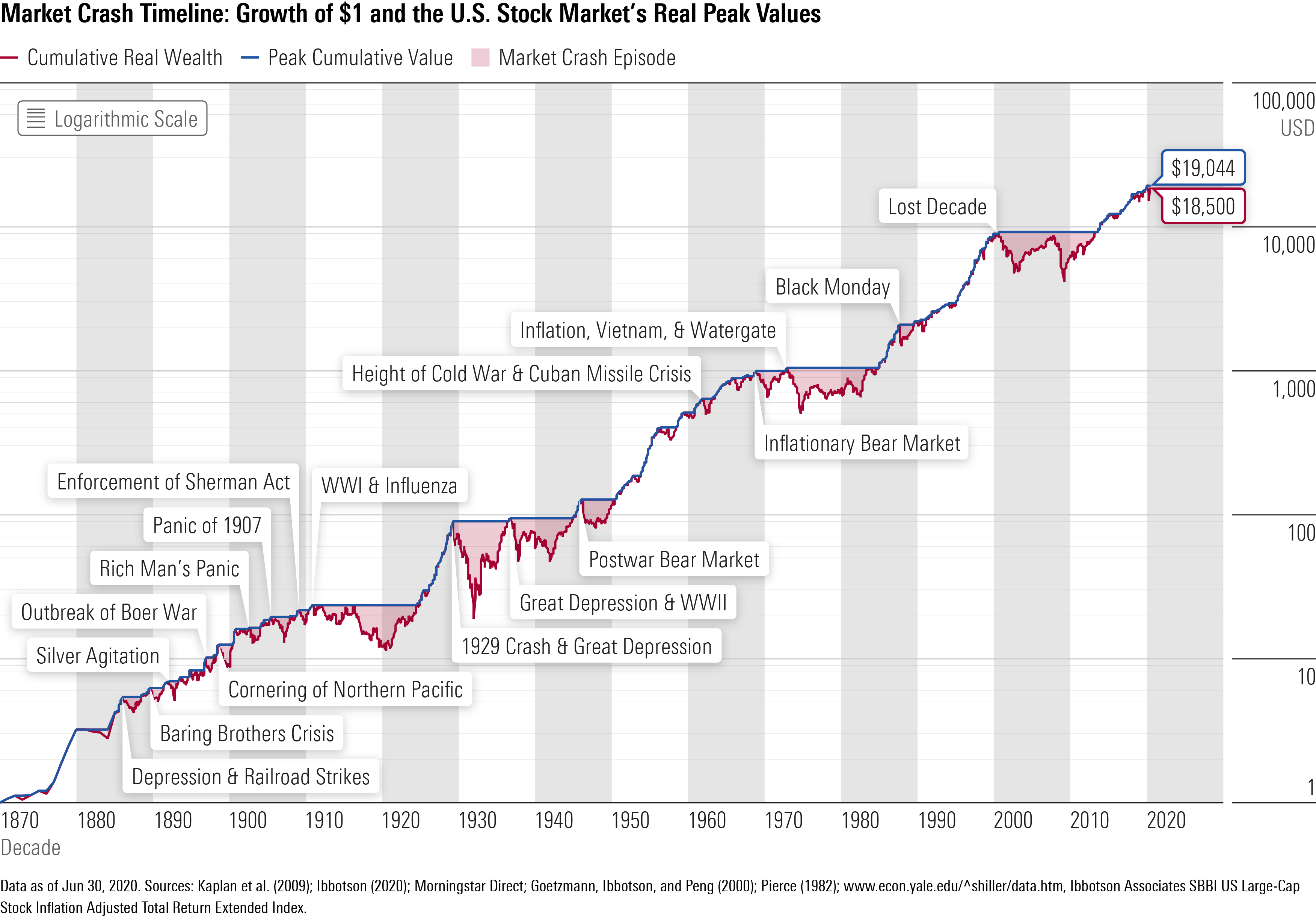

2013 Stock Market Bubble. Small changes may temporarily halt the project but. The stock market bubble of the 1920s the dot-com bubble of the 1990s and the real estate bubble of the 2000s were asset bubbles followed by sharp economic downturns.

A bubble is defined. Since a large part of what appears to be driving prices isnt sentiment the answer is likely no. The bottom line.

What Does A Bubble Mean In The Stock Market. All stock market bubbles eventually burst meaning that stock prices suddenly and sharply decline. A stock market bubble refers to a surge in share prices to levels significantly above their fundamental value.

The Dow Jones Industrial Average experienced a gain of 2650its largest in 18 years.

Stock Market Crash Overview How It Happens Examples

Stock Market Bubble Stock Market Pin Teepublic

Stock Market Bubble Definition Cause And Investing Strategy The Motley Fool

Market Bubbles It S Not The Price It S The Mentality Seeking Alpha

4 Reasons Why The Stock Market Keeps Rising Over The Long Term

Financial History Guide Option Alpha

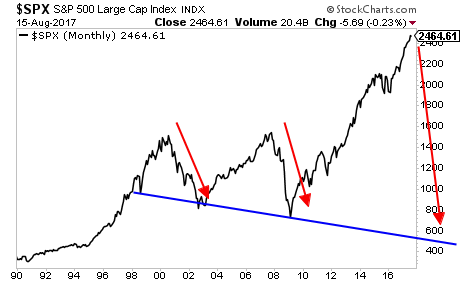

When Will The Stock Market Bubble Burst Nightly Patterns Overnight Trading

What Is A Stock Market Bubble Are We In A Stock Market Bubble Now

What Is An Echo Bubble Definition And Examples Market Business News

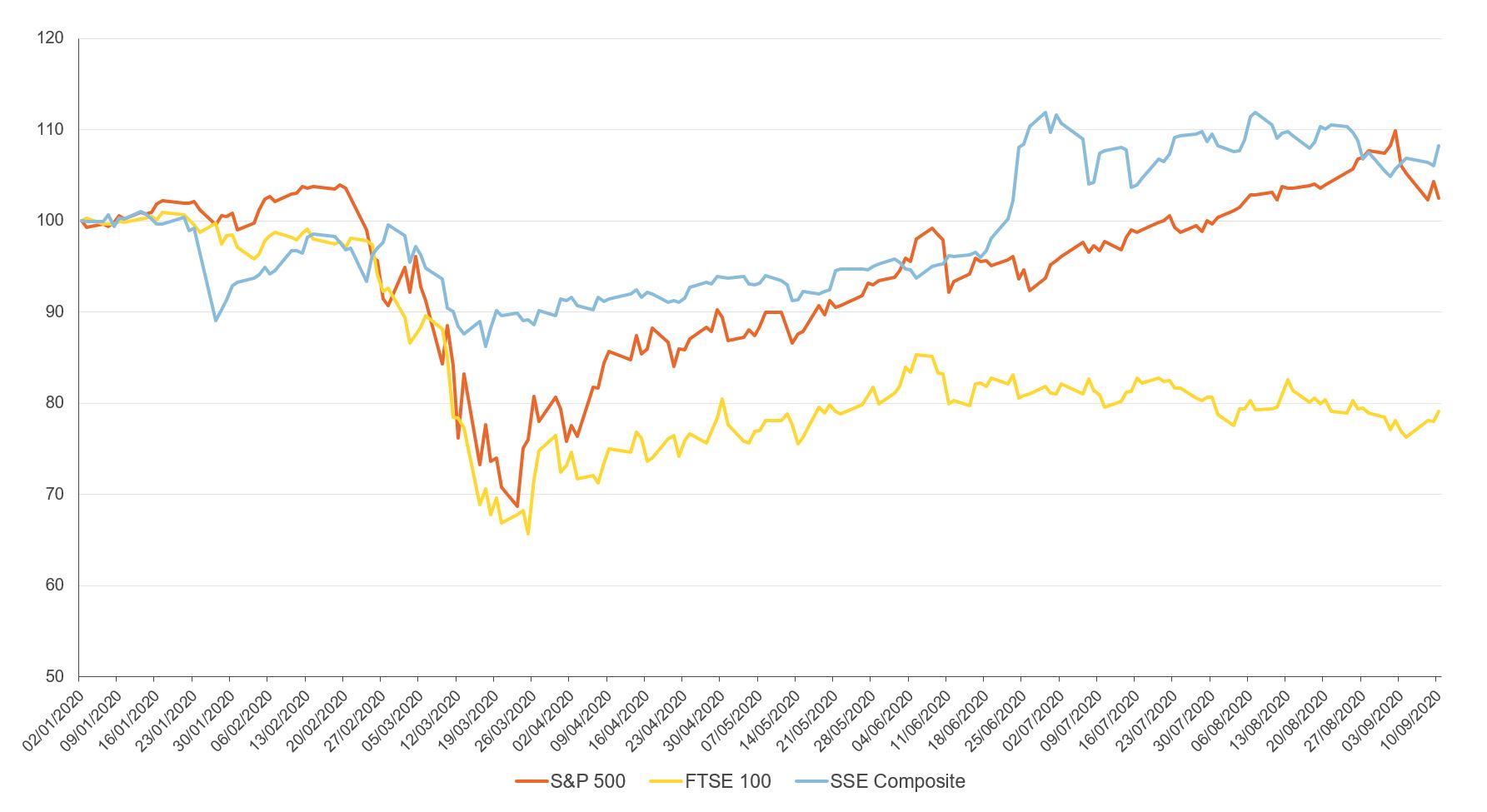

Why Has The Stock Market Bounced Back When The Economy Seems So Bad Economics Observatory

Four Causes Of The U S Stock Market Bubble Nasdaq

What Prior Market Crashes Taught Us In 2020 Morningstar

Stock Market Bubble Laptrinhx News

The Stock Market Bubble Is So Big Even The Fed S Talking About It Investing Com

Stock Market Crash Of 1929 Summary Causes Facts Britannica

Stock Market Crash Definition Causes How To Prepare

What Prior Market Crashes Taught Us In 2020 Morningstar

Millionaires Want To Own A Little Less Of Everything Bubble Next Year